JustTheFacts Max![]() October 29, 2025

October 29, 2025

1K views 0 Comments 0 Likes

JTFMax:

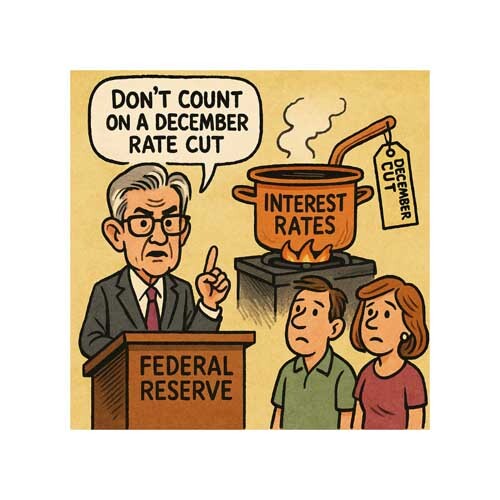

“Powell Puts December Cut on the Back Burner Amid Rate-Cut Déjà Vu”

In Washington this week, Jerome Powell, Chair of the Federal Reserve, delivered a not-so-sweet music note to borrowers and big-ticket spenders alike: yes, the Fed trimmed its benchmark rate for the second time this year, but no — don’t count on a December cut as a sure thing.

Here’s what happened: The Fed’s policy-making committee lowered the federal funds rate by a quarter-point, bringing the range down to 3.75% to 4%. That’s the most generous borrowing soundtrack we’ve had in three years. Two Fed officials dissented — one arguing for a larger half-point cut, the other for holding steady. (But beneath the surface tone of encouragement was a finer tune: Powell emphasized that the next move — expected by many in December — is far from guaranteed, thanks to divided internal views and incomplete economic data.

Why does this matter to us out here in the Coachella Valley, the greater Palm Springs area, and beyond? Because whether you’re financing a dream remodel, buying a pool heater, pulling the trigger on a new car, or simply managing the monthly check-out at your grocery cart — the rhythm set by the Fed matters.

What it means for everyday spending and big-ticket decisions:

If you’re in the market for a home loan, you’ll want to keep your ears tuned: a rate cut might make borrowing cheaper, but Powell’s caution means “soon” may be a hazy concept. For local families in the valley contemplating a home upgrade, or newer homeowners thinking of refinancing — now’s a time to ask lenders precise questions: what’s your credit-score cut-off, and how soon can you lock rates given this uncertainty?

You're also nudged to check your auto-loan terms or appliance financing — any pending rate reduction could ease your monthly burden, but if the Fed holds off, those savings won’t arrive as quickly as hoped. In short: if you can lock in favorable terms now, it might be smart, but waiting “just in case” a December cut will arrive is riskier than it sounds.

For everyday consumers, the message is more subtle: While inflation isn’t breaking out wildly yet, Powell flagged concerns about tariff-driven cost pressures downstream (yes, that’s you, whooped-up appliance prices, and rising component costs). That means the prices of things you buy might still inch up even as borrowing costs float downward.

For the Coachella Valley lifestyle:

In short: The Fed has given a little relief, but without a stamp-of-approval for December. Local residents should act as if the rate-cut door is slightly open — but with the “maybe, maybe not” sign hanging overhead. Smart borrowing now, budgeting for cautious optimism, and staying alert to financing terms will serve us better than waiting on an uncertain policy move.

Desert Local News is an invitation-only, members-based publication built on fact-checked, non-biased journalism.

All articles are publicly visible and free to read, but participation is reserved for members—comments and discussion require an invitation to join.

We cover local, state, and world news with clarity and context, free from political agendas, outrage, or misinformation.

Comments